Do you value local journalism? Support NottinghamMD.com today.

Freddie Mac on Thursday released the results of its Primary Mortgage Market Survey, showing Baltimore mortgage rates moving lower for the first time in four weeks.

The 30-year fixed-rate mortgage averaged 3.71 percent with an average 0.5 point for the week ending March 24, 2016, down from last week when it averaged 3.73 percent. A year ago at this time, the 30-year averaged 3.69 percent.

The 15-year fixed-rate mortgage this week averaged 2.96 percent with an average 0.4 point, down from last week when it averaged 2.99 percent. A year ago at this time, the 15-year averaged 2.97 percent.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.89 percent this week with an average 0.5 point, down from last week when it averaged 2.93 percent. A year ago, the 5-year ARM averaged 2.92 percent.

“The Federal Reserve’s decision last week to maintain the current level of the Federal funds rate combined with the reduction in their forecast for growth triggered a 3-basis point drop in the 10-year Treasury yield,” said Freddie Mac chief economist Sean Becketti. “As a consequence, the 30-year mortgage rate declined 2 basis points to 3.71 percent. However, comments this week by several members of the Fed, including the presidents of the Richmond, San Francisco, and Atlanta banks, indicated that a June rate hike is still on the table.”

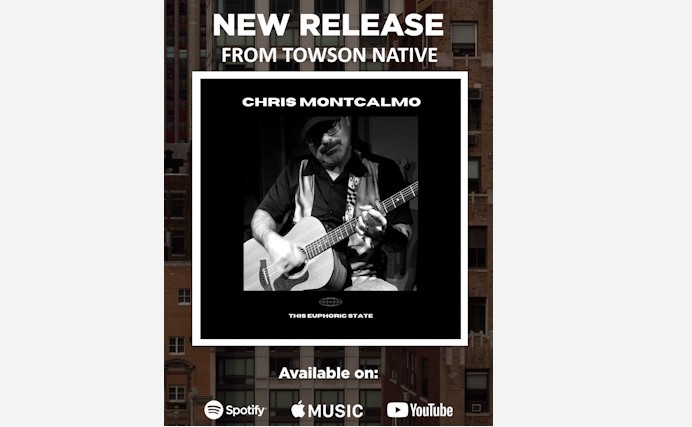

For more information on current Baltimore mortgage rates, contact Chris Montcalmo, your Maryland mortgage expert.